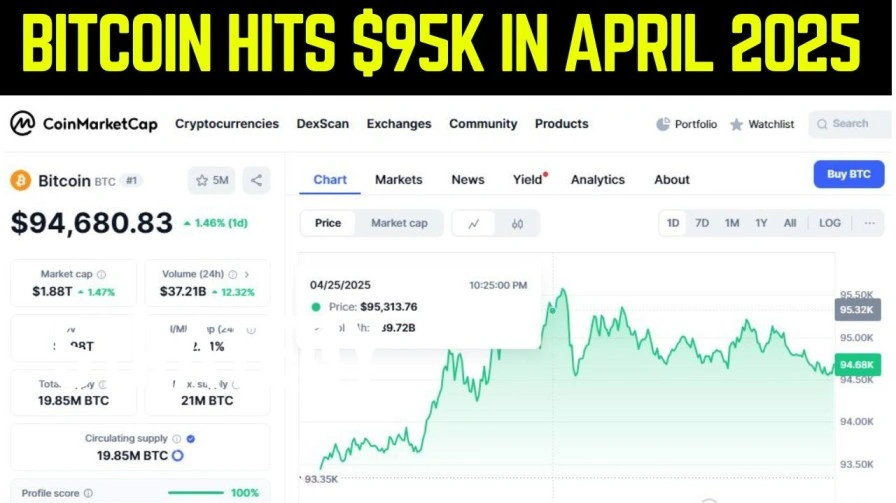

Bitcoin Hits $95K in April 2025: Bitcoin has skyrocketed to $95,000 in April 2025, sparking excitement and debate among investors worldwide. With institutional adoption surging and regulatory barriers falling, many are asking, is now the time to invest in Bitcoin? This article explores the factors driving Bitcoin’s rally, the risks and opportunities, and whether you should jump in. Check the Bitcoin live price.

What's Next

ToggleWhy Is Bitcoin Surging to $95K?

Several key developments have fueled Bitcoin’s meteoric rise in 2025:

- Spot Bitcoin ETFs Gain Traction: The approval of spot Bitcoin ETFs has opened the floodgates for institutional investment. Fidelity’s Bitcoin ETF alone saw $108 million in inflows recently, signaling strong market confidence.

- Regulatory Wins: The repeal of SAB 121 allows banks to hold Bitcoin, while FASB’s fair value accounting rules make it easier for companies to report crypto assets.

- Market Momentum: Bitcoin’s price has climbed steadily, reaching $95,136 recently, with a 1.42% daily gain. This momentum is drawing retail and institutional investors alike.

- Global Adoption: Stablecoins and Ethereum’s enhancements are boosting the broader crypto ecosystem, indirectly supporting Bitcoin’s dominance.

- Institutional Demand: Major hedge funds and corporations are adding BTC to their balance sheets.

- ETF Approvals: Spot Bitcoin ETFs continue to attract billions in inflows.

- Halving Effect: The 2024 Bitcoin halving reduced supply, pushing prices up.

- Macroeconomic Factors: A Weak dollar, inflation fears, and geopolitical tensions are driving crypto demand.

These factors have created a perfect storm, pushing Bitcoin to new heights and capturing global attention.

Should You Invest in Bitcoin Now?

Investing in Bitcoin at $91,000 is a high-stakes decision. Here’s a breakdown of the pros, cons, and considerations to help you decide.

Reasons to Invest

- Institutional Backing: Major players like Fidelity and MicroStrategy are doubling down on Bitcoin, suggesting long-term confidence.

- Limited Supply: Bitcoin’s fixed supply of 21 million coins makes it a hedge against inflation, especially as fiat currencies face pressure.

- Market Sentiment: Social media platforms like X are buzzing with optimism, with posts highlighting Bitcoin’s “upward momentum”.

- Portfolio Diversification: Adding Bitcoin can diversify your investments, reducing reliance on traditional assets like stocks or bonds.

Risks to Consider

- Volatility: Bitcoin’s price swings are notorious. A sudden correction could erase gains quickly.

- Regulatory Uncertainty: While recent changes are positive, global regulations remain inconsistent, posing risks.

- High Entry Point: At $91,000, Bitcoin is expensive, and buying at a peak could lead to losses if the market cools.

- Speculative Hype: Some argue the rally is driven by speculation rather than fundamentals, increasing the risk of a bubble.

Should You Buy Bitcoin at $95K? Experts Weigh In

Bullish Case (Reasons to Buy)

✔ 100K Target: Analysts at Bernstein and Standard Chartered predict 100K Target: Analysts at Bernstein and Standard Chartered predict 100K–$150K by 2025.

✔ Scarcity: Only 21 million BTC will ever exist—increasing adoption means higher prices long-term.

✔ Institutional Backing: BlackRock, Fidelity, and MicroStrategy continue accumulating BTC.

Bearish Risks (Reasons to Wait)

✖ Volatility: Bitcoin can drop 30%+ in weeks—risky for short-term traders.

✖ Regulatory Threats: SEC crackdowns or bans in major economies could crash prices.

✖ Overbought Signals: RSI levels suggest BTC may be due for a short-term correction

Key Considerations

Before investing, ask yourself:

- What’s your risk tolerance? Bitcoin is not for the faint-hearted.

- What’s your investment horizon? Long-term holders often fare better than short-term traders.

- How much can you allocate? Experts recommend limiting crypto to 5-10% of your portfolio.

Best Strategies If You Invest Now

- Dollar-Cost Averaging (DCA): Buy small amounts weekly to reduce risk.

- Hold Long-Term (3–5 years): Historically, BTC rewards patient investors.

- Set Stop-Losses: Protect profits if the market reverses suddenly.

How to Invest in Bitcoin Safely?

If you decide to invest, follow these steps to minimize risks:

- Choose a reputable exchange: Platforms like Coinbase, Binance, or Kraken offer secure ways to buy Bitcoin (government-approved exchanges only).

- Use a Secure Wallet: Store your Bitcoin in a hardware wallet (e.g., Ledger) or a trusted software wallet for safety.

- Start Small: Invest only what you can afford to lose, especially at current prices.

- Stay Informed: Follow trusted sources like Asiaglobalbank.com for real-time finance updates.

- Monitor the Market: Use tools like CoinMarketCap to track Bitcoin’s price and trends.

What Experts Are Saying

Industry voices are divided:

- Bullish: Michael Saylor, MicroStrategy’s chairman, sees Bitcoin as “digital gold” and a must-have asset.

- Cautious: Some analysts warn that $91,000 may be a psychological barrier, and a pullback is possible if ETF inflows slow.

The Bigger Picture

Bitcoin’s 2025 rally is part of a broader shift in finance. As banks, corporations, and governments embrace crypto, the asset class is becoming mainstream. For investors in Asia and beyond, Bitcoin offers a chance to participate in this global transformation—but only if approached with caution and strategy.

Conclusion: Is Bitcoin Worth It in April 2025?

Bitcoin’s climb to $91,000 is a historic moment, driven by institutional adoption and regulatory breakthroughs. While the potential for further gains is real, so are the risks of volatility and market corrections. If you’re considering investing, do your research, start small, and align your strategy with your financial goals.

If you believe in Bitcoin’s long-term store of value, buying now could still be profitable—but expect wild swings. For conservative investors, waiting for a pullback to 80K–80K–85K may offer a better entry.

What’s Next? Keep an eye on:

- Fed interest rate decisions

- Bitcoin ETF inflows

- Upcoming crypto regulations

Stay ahead of the curve with Asiaglobalbank.com for the latest finance and crypto news.

Disclaimer: Investing in Bitcoin carries risks. Consult a financial advisor before making decisions.

FAQs: Bitcoin at $95K– Should You Invest?

Why did Bitcoin surge to $95K in April 2025?

Bitcoin’s rally is driven by institutional ETF inflows, the 2024 halving (reduced supply), and macroeconomic uncertainty pushing investors toward crypto as a hedge.

Is Bitcoin a good investment at $95K?

It depends on your risk tolerance. Long-term holders may still profit (experts predict $100K+), but short-term traders risk volatility. Dollar-cost averaging (DCA) is a safer strategy.

Will Bitcoin reach $100K in 2025?

Analysts at Bernstein and Standard Chartered forecast 100K–100K–150K, but regulatory crackdowns or market corrections could delay this.

Should I wait for a Bitcoin price drop before buying?

Historically, BTC sees 20–30% pullbacks after ATHs. If you’re risk-averse, waiting for a dip near 80K–80K–85K may offer a better entry.

What are the biggest risks of buying Bitcoin now?

Price volatility (sharp drops are common)

Regulation (e.g., SEC lawsuits, country bans)

Competition (Ethereum, Solana gaining traction)

How high can Bitcoin go long-term?

Cathie Wood’s ARK Invest predicts $1M+ per BTC by 2030, but this assumes mass adoption as a global reserve asset.

Are Bitcoin ETFs a safer way to invest?

Yes. Spot Bitcoin ETFs (like BlackRock’s IBIT) offer exposure without self-custody risks. Fees are low (~0.25%), and they’re SEC-regulated.

What’s the best strategy for investing in Bitcoin today?

DCA: Buy fixed amounts weekly/monthly.

Hold for 3+ years: Avoid panic-selling during dips.

Allocate wisely: Don’t invest more than 5–10% of your portfolio.

Could Bitcoin crash below $50K again?

Yes. In past cycles, BTC fell 50–80% after ATHs. However, each recovery reached new highs.

Where can I buy Bitcoin safely?

Approved exchanges only.

Join WhatsApp Channel

Join WhatsApp Channel Join Telegram Channel

Join Telegram Channel